Income in Retirement - How Much?

As you look forward to retirement you certainly have anxiety about how much retirement income you will need versus how much income you will have. The planning questions you probably ask yourself include –

How long should I work?

How much extra should I be saving in the Deferred Compensation Plan?

Save more in a Roth IRA?

How much will my SLOCPT pension be?

Any other pensions?

My Social Security benefit?

What other savings, income, inheritances, home equity might I have?

Should I work part-time in retirement?

Underlying all these planning considerations are expectations about how much retirement income will you actually need?

Do I need to make the same income in retirement that I made in my last few years of full-time employment?

Probably not – but it depends… The rule-of-thumb is that you will need about 70%-80% of your pre-retirement income to maintain the same lifestyle.

Why might your income needs be lower in retirement?

No more pension contributions or Social Security deductions.

Housing costs – may be steady if you own your home even if you still have a mortgage. But could escalate if you lease or “trade-up” to a different home.

Medical costs partially covered by Medicare if over age 65.

Less need to replace a car.

Dependent care cost may be lower (the kids finally move out…)

Could my income needs be higher in retirement?

Offsetting the generally lower retirement income needs can be increased costs depending on your particular circumstances -

Inflation over the long run will erode your purchasing power. Your SLOCPT pension has COLAs, but with a 2% or 3% maximum each year. Social Security generally matches full inflation, but that program could change.

Travel and enhanced lifestyle costs (e.g., buy a boat).

Medical costs – depends on your health situation and the type of insurance coverage you have. Particularly in later years.

Will my income needs vary throughout my retirement?

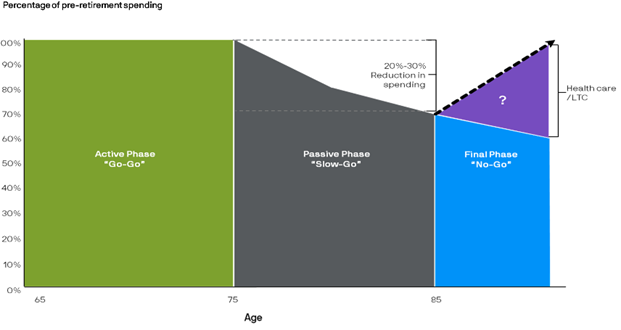

Income needs in retirement tend to go through phases. The graphic below from “The Prosperous Retirement” by Michael Stein illustrates this quite well.

An excellent “Guide to Retirement” is published by J.P. Morgan Asset Management. See the link below -

Guide to Retirement | J.P. Morgan Asset Management (jpmorgan.com)

I encourage you to browse through this document for ideas. It is mostly geared towards individuals who do not have a Defined Benefit pension like you do through the SLOCPT – but it is still chock-full of useful information.

Back to that 70%-80% of pre-retirement income I need – is it the same for everyone?

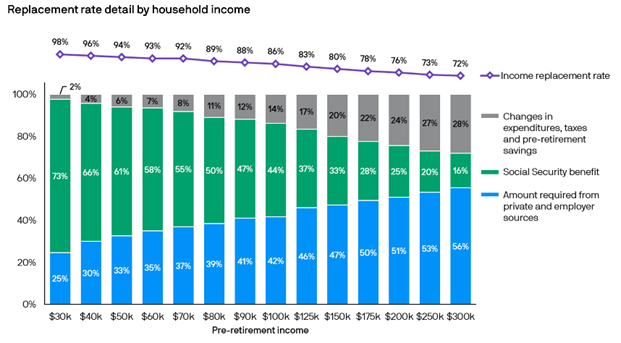

Rules-of-thumb are never completely applicable to everyone (except for the one about never touch a hot stove). The graph below from J.P. Morgan shows not only the expected income replacement needs but the share that may come from Social Security – all varied by current household income.

This research indicates:

The higher your household income, the less of that income needs to be replaced.

Social Security is, and always has been, an insurance program - not a conventional pension. Meaning; SS is a “progressive” benefit that replaces a larger portion of income at lower levels and a smaller percentage at higher incomes.

As always – contact the SLOCPT at 805/781-5465 or email at slocpt@co.slo.ca.us for questions about the SLO County pension that is a core part of your retirement plan.

By Carl Nelson

Executive Director, SLO County Pension Trust